Understanding Commercial Viability

Commercial Viability Explained

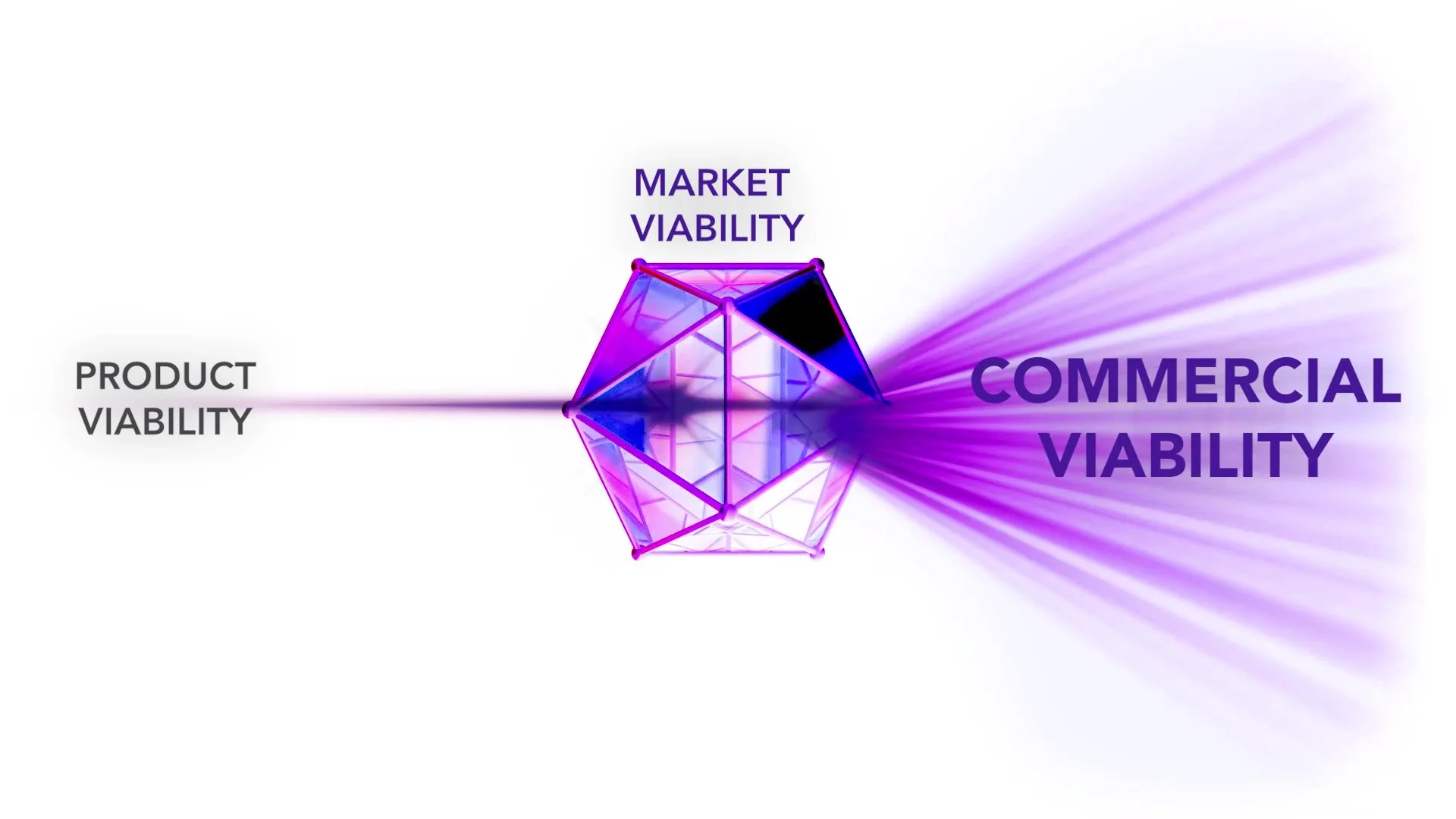

Product viability – whether the product works as intended – is where the engineering, product development, clinical, regulatory, and quality pathways, among others, are critical. A product may work well in limited bench testing, for example, but have design characteristics that do not translate to larger scale production. Or it may show promising results in animal testing but have certain nonapparent limitations that render human trials cost prohibitive or otherwise unlikely to succeed.

Every medical technology company, of course, must successfully execute all aspects of product viability, but most founders and their financial backers make the crucial mistake of focusing almost exclusively here during the first several phases of the product development timeline, without the necessary regard to incorporating the inputs and effects of market viability in their strategy and product development plans.

Market viability, equally compelling and important, is far more subjective and difficult for early-stage companies to determine. Successful validation of a market and its receptivity to new technology is a major valuation accelerator for inventors and investors.

To achieve a successful outcome, these market viability factors – which RQR assesses through the “7 Domains of Commercial Quotient™” – must be assessed continuously in the product development cycle, as they will significantly influence product viability decisions and strategy.

Market Viability Drives Product Viability

Assessing market viability requires answering a series of key questions:

Is there a compelling market need?

Who is the customer, the key decision makers, and the physician champion?

Are there multiple call points in the clinical workflow, which will increase complexity and reduce the likelihood of adoption?

Will healthcare companies and consumers believe they need it?

Is there a reimbursement pathway with coding, coverage, and payment?

Is the IP position secure and defendable?

Is there a strategic buyer that has an unmet need for the product in its existing portfolio?

In short — even if product functionality is likely strong and supportable with data — why will anyone buy it and can the company make money on it?

RQR Advisors helps answer these interdependent questions and explain to investors and strategics alike how the overall commercial viability of a technology justifies further investment or ultimate acquisition.

“Commercial viability is the only currency that matters. It’s what turns ideas into investments — and investments into acquisitions.”